Irrationaler Unterschwang 3.0 - Edelmetallaktien extrem unterbewertet

08.10.2014 | Dr. Uwe Bergold

Nachdem wir im vergangenen Marktkommentar 08/2014 ("Irrationaler Überschwang 3.0": www.goldseiten.de) die aktuell extreme Überbewertung am Standardaktienmarkt aufgezeigt haben, wollen wir diesmal das Spiegelbild, den "Irrationalen Unterschwang 3.0" bei den Edelmetallaktien, visualisieren.

Nachdem wir im vergangenen Marktkommentar 08/2014 ("Irrationaler Überschwang 3.0": www.goldseiten.de) die aktuell extreme Überbewertung am Standardaktienmarkt aufgezeigt haben, wollen wir diesmal das Spiegelbild, den "Irrationalen Unterschwang 3.0" bei den Edelmetallaktien, visualisieren.Ergänzend zum letzten Marktkommentar (Epochale Aktienmarktüberbewertung), wollen wir noch auf den Inhalt des E-Mails verweisen, dass das weltweit führende Investment Research Unternehmen Ned Davis Research Inc. (http://www.ndr.com/) am 19.09.2014 mit dem Titel "Valuation and Sentiment Indicators at extremes" versandt hat:

Ned Davis outlines some key valuation and sentiment indicators that, have proved accurate in the past, are pointing to extremes:

- Valuation

• S&P 500 Median Price/Sales Ratio - shows that the median of the 500 stocks in the S&P 500 sell at a record extreme of 2.08 times sales. The norm over the past 50 years is 0.88 times sales. people who argue that stocks are a good value are clearly not talking about this chart.

• Value Line Median Appreciation Potential - has been one of the more effective valuation indicators since 1980. Recently, the indicator fell to a record low, below the 2000 and 2007 market peaks.

• Valuation indicators only work long term? - In regard to these valuation extremes, Ned Davis liked a quote he saw from Mark Hulbert citing Ben Inker, money manager, who likens the market to a leaf in a hurricane: “You have no idea where the leaf will be a minute or an hour from now, but eventually gravity will win out and it will land on the ground.” - Sentiment

• Investor Intelligence survey - recently the outright bears as measured by Investors Intelligence fell to 13.3%, which is the lowest level since 1987. The chart shows a four-week smoothing on the bears. Thus, we are now at a 27-year sentiment extreme from bearish advisors.

• NASDAQ 100 vs Inverse OTC/OTC Fund + Inverse OTC Fund Assets - This is not a sentiment survey, but actual real money bets invested in NASDAQ speculative funds - short over short plus long - and recently just 1% of the assets are in the short fund. Thus, among NASDAQ speculative traders, we have 99% bulls, higher than seen at the 2000 bubble peak.

Ned Davis Research (NDR), since 1980, has been providing clients with a disciplined and objective approach to global investment research.

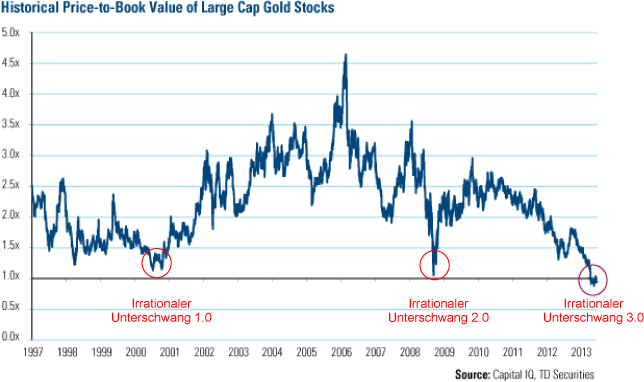

Dritte extreme Unterbewertungssituation im Goldminensektor seit 2000

Abb. 1: Kurs-Buch-Verhältnis der großkapitalisierten Senior-Goldminen von 1997 bis 2013

Quelle: Capital IQ TD Securities

Quelle: Capital IQ TD Securities

Spiegelbildlich zu den epochal überbewerteten Standard-, zeigen sich die, seit über einem Jahr, historisch unterbewerteten Edelmetallaktien. Betrachtet man das Kurs-Buch-Verhältnis in Abbildung 1, so erkennt man, dass diese fundamentale Substanzbewertungskennzahl seit Mitte 2013 ein absolutes Tief, mit der Oszillation um 1, markiert hat.

Abb. 2: GOLD (oben rot) und XAU-Goldaktien-Index (oben schwarz) vs. XAU-GOLD-Ratio (unten)

Quelle: GR Asset Management GmbH

Quelle: GR Asset Management GmbH